Klarna’s climate action strategy

Climate change is one of the great challenges of this century. Klarna acknowledges that its business has an impact on the climate and is committed to supporting solutions that help address the climate crisis, both within its own value chain and beyond. At the heart of Klarna’s climate change mitigation strategy are: a) an ambitious target to reach net zero emissions across its value chain by 2040, independently validated by the Science Based Targets initiative, and b) a commitment to take responsibility for those emissions it has not yet reduced by pricing them with an internal carbon fee and using the funds to support the solutions needed to reach global net zero. Klarna is a founding partner of the Climate Transformation Fund, the ‘beyond-offsetting’ charitable fund curated by Milkywire that selects and supports a wide range of projects addressing the climate crisis within the durable carbon removal, nature restoration & protection, and decarbonization sectors. By supporting solutions through the CTF, Klarna’s focus is to fund solutions that deliver catalytic impact and forge a pathway to meet our global climate goals.

$8.5M

Fund total: $18.7M

Klarna has contributed $8.5M since 2021.

67

Klarna has supported a total of 67 projects in 29 countries.

Klarna’s internal carbon fee

While Klarna is on its journey to reduce emissions to net zero by 2040, there will be GHG emissions that are yet to be reduced. Klarna is taking responsibility for these emissions and applies a voluntary internal carbon fee to all its annual greenhouse gas (GHG) emissions. The tax rates are differentiated based on the source of emissions to reflect the varying levels of control Klarna has over each emission category and the shared responsibility for Scope 3 emissions across the value chain: - USD 200 per ton of CO₂e for Scope 1 and Scope 2 emissions. - USD 100 per ton of CO₂e for Scope 3 emissions related to business travel (Category 3.6). - USD 10 per ton of CO₂e for all other Scope 3 emissions.

Supporting climate solutions

Klarna uses the funds generated through its internal carbon fee to finance Beyond Value Chain Mitigation (BVCM) via the Climate Transformation Fund (CTF). In this model, rather than focusing on “offsetting” its own emissions, Klarna uses the funds to finance a portfolio of climate projects focused on maximizing overall climate impact. As suggested by many experts, this approach is a much-needed evolution of the way companies have traditionally financed climate action and Klarna is amongst the first large businesses pioneering it worldwide.

Climate Transformation Fund

Milkywire's Climate Transformation Fund, established in 2021, focuses on innovative projects that accelerate progress toward net-zero targets and align with ambitious sustainability leadership goals. Our mission is to achieve maximum long-term CO₂ reduction or removal per dollar spent. We're committed to supporting new technical solutions, influencing climate policy for greater ambition, and scaling up nature-based projects. With 49 projects already backed and 15+ partners on board, we're paving the way for a sustainable future.

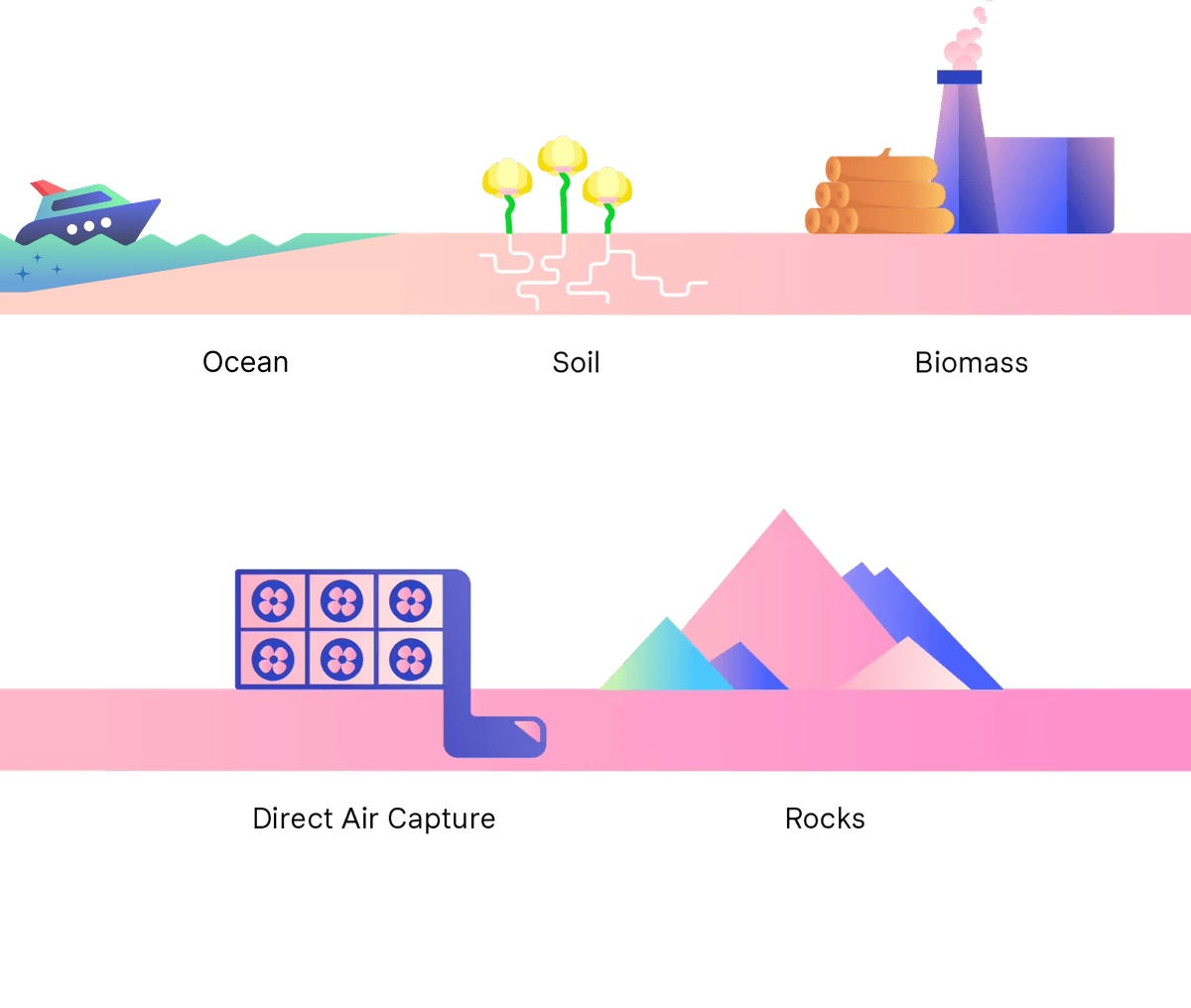

Durable carbon removal (CDR)

Canada

Canadian TerraFixing captures CO₂ from the air via a novel Direct Air Capture process that employs adsorption technology. It is designed to operate in cold, remote locations where extracting CO₂ from the air is easier and cheaper, and where the scalability of renewable wind power is large. The greatest challenge with DACs is likely electricity consumption. The electricity must be cheap, clean and the DACs company should not crowd out other uses of the clean electricity. Furthermore, building large amounts of clean electricity quickly is difficult due to permitting and grid connection delays. TerraFixing’s technology sidesteps much of this thanks to the possibility of deploying in remote locations where renewable energy can produce more and there is little competition for the electricity.

Decarbonisation

United Kingdom

Opportunity Green is working to end the exemption of international flights from the EU Emissions Trading System, which leaves more than 80 MtCO₂ unregulated each year. Through legal interventions, policy briefs, and alliances with innovative aviation companies, the initiative builds the case that including long-haul aviation is essential for EU climate integrity and competitiveness. The strategy also leverages Ireland’s upcoming EU Council Presidency and support from climate vulnerable countries to secure reform. Bringing international aviation into the ETS would close a major gap in EU climate policy and generate significant revenues for climate action.

Nature protection and restoration

Ecuador

The Kawsay Ñampi project, led by the Kichwa People of Sarayaku in the Ecuadorian Amazon, protects 142,500 hectares of intact rainforest through Indigenous governance and modern monitoring tools. The project is developed under the Climate Justice Standard, which ensures that the project channels most funds directly to community priorities while piloting an ethical, non-offset Climate Justice Contribution model. It offers a replicable pathway for Indigenous-led, high-integrity climate and biodiversity solutions.

Why funding climate solutions matters

Taking meaningful climate action is essential for addressing the climate crisis. Strategies like internal carbon fees allow businesses to invest in high-quality projects that tackle critical challenges, such as carbon removal, nature restoration, and reforestation, while driving measurable and lasting impact. This approach fosters innovation, accountability, and real progress toward a net-zero future. Milkywire supports companies in achieving effective climate action through its proven Climate Transformation Fund. Aligned with leading frameworks like SBTi and guided by top scientific experts, the fund ensures every contribution supports impactful, science-backed projects. With rigorous quality assurance, transparent reporting, and a focus on maximizing outcomes, Milkywire offers a best-in-class solution for funding meaningful environmental change.